Counting down to the US elections

Views & insightsUS elections are always significant, a point of interest around the world, but many are seeing this November’s as particularly so. Our Head of Research, Guy Foster, looks at whether the Democrats’ status as favorites is well-founded, and what a Democratic victory might mean.

21 September 2020 | 3 minute read

US elections are always significant, a point of interest around the world, but many are seeing this November’s as particularly so. Our Head of Research, Guy Foster, looks at whether the Democrats’ status as favorites is well-founded, and what a Democratic victory might mean.

Former Vice President Joe Biden continues to hold his lead over President Trump in the betting markets, but in the Senate race the polls have tightened with the Democrats losing what had, only a month ago, looked a dominant lead over the Republicans.

Can we trust the polls?

Polls however, as we all know, are not always correct.

They are of particular interest this time around because four years ago only a handful of polls predicted a Trump victory – Clinton was the clear favourite. This was because Clinton’s support in some key midwestern states was overestimated due to a methodological issue by most pollsters, and because a historically large number of late deciding voters ultimately plumped for President Trump.

While in response to the first point, the pollsters have been adjusting their models to improve them this time round. But it’s too early to say how many undecided voters there will be come election day and the scope for errors always remains.

Most polls though have Biden leading by a clear margin – and these are supported by other indicators that suggest the election could well go in the Democrats’ favour.

It’s the economy, stupid

When Bill Clinton’s presidential campaign strategist James Carville coined the famous line “the economy, stupid” in 1992, he was aware of its historical impact on presidential elections.

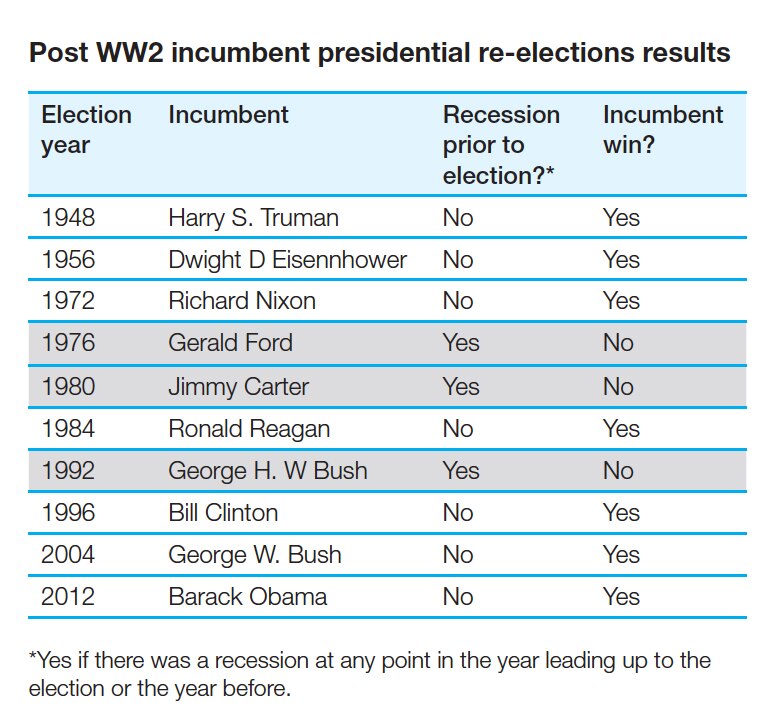

The following table shows that since 1950, the only times an incumbent president was running for his second term and lost was when there was a recession in the year of the election or the year prior. This happened to Gerald Ford in 1976, Jimmy Carter in 1980 and George H. W. Bush in 1992.

While President Trump has placed great emphasis on being pro-business during his time in office, with the first three years marked by growth in the economy, employment and the stock market, many believe that the impact of the Covid-19 crisis on one of the key pillars of his politics is so significant that it could be terminal.

Having said that, there are still two months until the election and things can change quickly, but given the deep recession this spring, history would suggest that this election is Biden’s, and the Democrats’, to lose.

What about the House and Senate?

Any president typically needs other levers of government to advance their policy agenda.

That means the House and Senate elections on 3 November are also crucial. If either side is able to take a clean sweep of presidency, House and Senate, it dramatically alters their ability to pass legislation and drive change.

For much of the year, the Democrats have polled well ahead of the Republicans, making a unified Democratic government look likely. The House of Representatives looks very likely to remain in Democratic hands, but in the last few weeks the polls have narrowed in the Senate race, making it close to a coin flip at this stage.

What would a Democratic victory mean for the markets?

Traditionally, a Democrat sweep would be seen by the markets less positively than a Republican victory.

However, in the current circumstances a unified Democratic government wouldn’t be all bad news for stocks, as they would likely ramp up spending.

We would expect more spending to fight the Covid-19 crisis, as well as substantial environmental and infrastructure related investment, which would support the economy. Education, health and housing would likely also see investment.

Meanwhile, some of their policies opposed by businesses, such as a higher minimum wage (which would hurt profit margins), have a silver lining – stronger consumption and therefore corporate revenue growth. Plus, we would expect a Biden presidency to be less confrontational on the world stage, easing the nerves of many.

On balance though, Democrat policies would seem to be a slight negative for the equity market. US profits enjoyed a nice boost in 2018 on the back of the Trump tax cuts for businesses, and corporate taxes will very likely move higher if Biden wins the presidency and the Democrats win back the House.

Taxes for higher earners would likely also rise. It is predominantly this cohort of society that invests in stocks, so higher taxes would mean less savings that could be put into equity markets.

A further risk is regulation. A survey conducted by the National Federation of Independent Business shows that small business concern about regulation and red tape rose sharply under Obama and then dropped again under Trump. Biden is generally considered to have very similar policy positions to Obama, so we would expect such concerns to reappear. On the margin, new regulations would hurt businesses’ willingness to invest, which would have implications for corporate profits.

In terms of the sectors most impacted, the Democrats would expand Medicare, which would have negative implications on pharmaceutical companies’ pricing power – Medicare’s drug spending is equivalent to almost 45% of Big Pharma’s total sales. Trump is also calling for a cap on drug prices, although in four years he hasn’t acted upon it and so it is seen as less of a threat. Expanding Medicare would likely also reduce the pricing power of private health insurance, as the public health option would benefit from government subsidies, boosting its competitiveness.

There would also be greater regulation on fossil fuel producers, as Biden is seeking to eliminate carbon emissions by 2035, which has implications for energy stocks.

The bottom line is that while a unified Democratic government would be a headwind for the stock market because of higher taxes and regulation, it is not the kind of event which halts a stock market expansion in its tracks. That kind of market impact is really the preserve of recessions and rising interest rates which seem unlikely at this stage.

The coming months will see plenty of fluctuations, as the market seeks to predict which way the vote will go. That may continue after election day – if the candidates choose not to concede defeat. While investors expect there would be a negative effect on markets if that was still the case by the following Monday, it would not be disastrous. At the moment, the markets are actually more concerned about vaccine development than the elections.

Guy Foster, Head of Research

Guy leads Brewin Dolphin’s Research team, providing recommendations on tactical investment strategy to Brewin Dolphin’s investment managers and strategic recommendations to the group’s Asset Allocation Committee. He is a CFA charterholder, holds the CISI Diploma, and is a member of the Society of Business Economists. Guy frequently discusses financial issues with the written and televised media as well as presenting to the staff and clients of Brewin Dolphin.

Past performance is not reliable guide to future.

The value of your investment may go down as well as up.

You may lose some or all of the money you invest.

Your investment may be affected by changes in currency exchange rates.

Any income you get from this investment my go down as well as up.