Is now a good time to invest?

Market news Views & insightsWhen markets are volatile, staying focused on your long-term goals is more important than trying to work out the ‘right’ time to invest. Here’s why.

11 January 2022 | 3 minute read

“As the old investment adage goes, it’s about time in the market – not timing the market”

When stock markets are volatile, it is easy to lose sight of the big picture and let your emotions get the better of you. Although this is perfectly natural, it is more important to focus on your long-term goals than attempt to work out the ‘right’ or ‘wrong’ time to invest.

No-one knows whether a market downturn is around the corner. Yet history shows that, over time, markets tend to recover.

Holding your nerve

When markets are falling, you might be tempted to cash in rather than endure more falls. But while this is a natural inclination, doing so only serves to crystallise losses.

Although periods of volatility are worrying, they can sometimes present opportunities for investors. For example, sell-offs could offer the chance to buy shares in businesses at cheaper valuations. And the sooner you start investing, the sooner you have time on your side to produce potential long-term returns.

Time in the market

As the old investment adage goes, it’s about time in the market – not timing the market. This means committing your money to the markets and leaving it invested – for at least five years, ideally longer – rather than waiting for what you might perceive to be the best time to invest. The longer you invest, the greater your potential for making a profit. It doesn’t typically pay to hold off on an investment decision if you’ve got time on your side.

After all, it’s impossible to know when the bottom of the market will be reached. There are plenty of factors that will impact this, and there might be further short-term pain. Yet trying to time the market, or cashing in, risks missing out on some of the market’s best days.

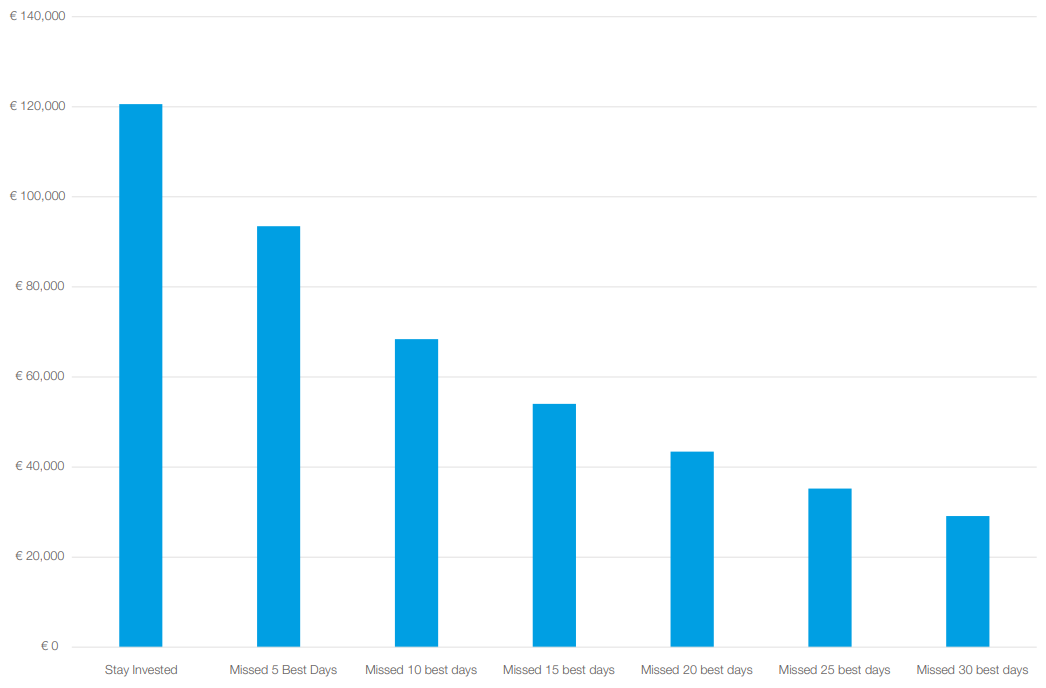

The effect of missing the market’s best days on a €10,000 investment over three decades

Source: Brewin Dolphin / Refinitiv Datastream

Returns are total returns of the FTSE All Share Index over the period 1 May 1989 to 29 November 2021 based on a €10,000 initial investment, with the assumption that all dividends paid out are reinvested.

Warning: These figures are estimates only. They are not a reliable guide to the future performance of your investment.

Warning: Past performance is not a reliable guide to future performance.

Managing risk

Your returns will be subject to stock market movements. But you can reduce volatility by placing your money in a broad range of asset classes across the globe.

No matter when you invest, losses to one investment could be offset by gains to another because they won’t react in the same way to economic shocks. Over time, this could reduce the impact of volatility on your investments’ performance.

Taking action

Periods of uncertainty are undoubtedly unsettling. Yet if you’ve no immediate need for your spare cash, and some set aside for emergencies, investing for your long-term goals could give you some sense of control over your financial future.

Brewin Dolphin Wealth Management Limited trading as Brewin Dolphin and Brewin Dolphin Ireland, is regulated by the Central Bank of Ireland.

For UK-based clients only: Brewin Dolphin Ireland is deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Financial Services Contracts Regime, which allows EEA-based firms to operate in the UK for a limited period to carry on activities which are necessary for the performance of pre-existing contracts, are available on the Financial Conduct Authority’s website. Registered Office: 3 Richview Office Park, Clonskeagh, Dublin 14. Registered in Dublin, Ireland No. 235126.